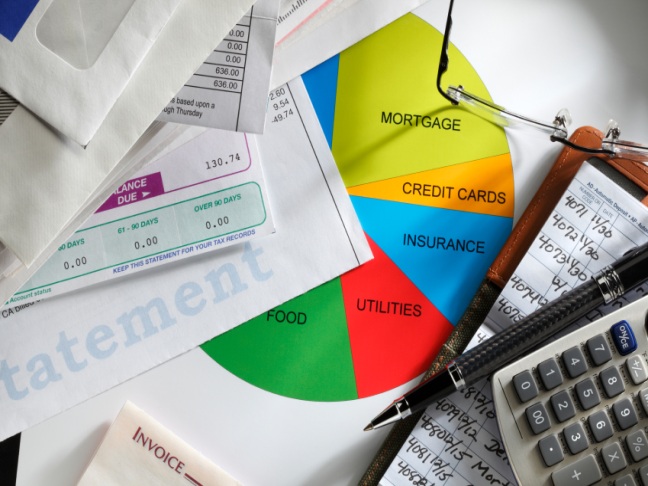

Have you ever heard the saying “Pay yourself first“? Basically, what it means is that before you sit down to pay your mortgage, your car payment and your electric bill, you make sure you have paid yourself first. This is a great way to ensure that you hit your savings goals each month.

Too often, families…